World Investment Report 2019

Overview

SEZs are spreading rapidly around the world

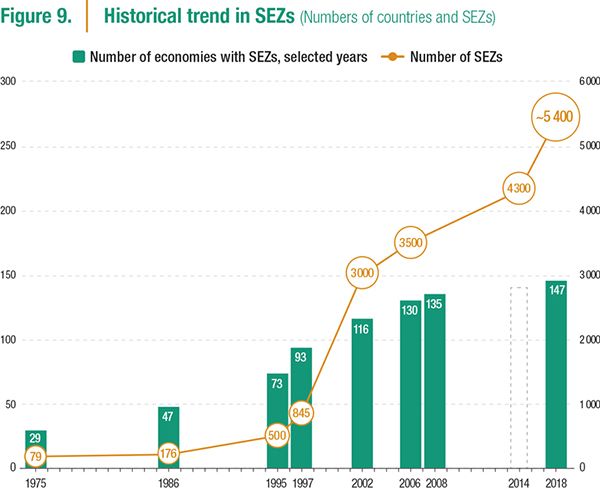

Special economic zones (SEZs) are widely used in most developing and many developed economies. In these geographically delimited areas, governments facilitate industrial activity through fiscal and regulatory incentives and infrastructure support. There are some 5,400 zones across 147 economies today, up from about 4,000 five years ago, and more than 500 new SEZs are in the pipeline (figure 9). The SEZ boom is part of a new wave of industrial policies and a response to increasing competition for internationally mobile investment.

Most zones offer fiscal incentives, relief from customs duties and tariffs; business-friendly regulations with respect to land access, permits and licenses or employment rules; and administrative streamlining and facilitation. Infrastructure support is another important feature, especially in developing countries where basic infrastructure for business outside these zones can be poor.

Zone types vary following an SEZ development ladder

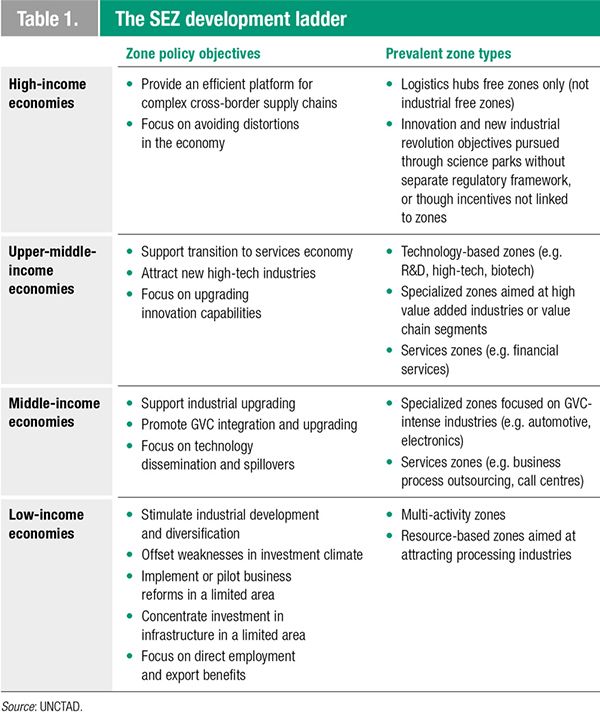

There are many types of SEZs. Basic free zones focused on facilitating trade logistics are most common in developed countries. Developing economies tend to employ integrated zones aimed at industrial development, which can be multi-industry, specialized or focused on developing innovation capabilities. The degree and type of specialization is closely linked to countries’ level of industrialization, following an SEZ development ladder (table 1).

Many new types of SEZs and innovative zone development programmes are emerging

Some focus on new industries, such as high-tech, financial services, or tourism – moving beyond the trade- and labour-intensive manufacturing activities of traditional SEZs. Others focus on environmental performance, science commercialization, regional development or urban regeneration.

Despite the emergence of new forms of zones linked to natural resources, aimed at domestic markets or intended as incubators for start-ups and small and medium-sized enterprises, most SEZs remain essentially a part of countries’ competitive investment promotion package, together with other forms of incentives.

International cooperation on SEZ development is increasing

Zones developed with a foreign partner are increasingly common. Despite the attention that government-to-government partnership zones have attracted, the majority are built with international private zone-development firms, without formal agreements with a foreign government.

Nevertheless, formal international cooperation on zone development is a growing phenomenon. A mixture of development assistance, economic cooperation and strategic considerations is driving the development of partnership zones with the support of investor home countries. Major donor countries and multilateral development institutions have included the development of SEZs in their development cooperation programmes.

Advantages for developing countries constructing SEZs with a foreign partner include sharing development costs, tapping into the expertise and experience of partner countries and foreign zone developers, and gaining preferential access to an established investor network.

Regional integration initiatives have also promoted the establishment of SEZs along regional economic corridors. Regional development zones and cross-border zones spanning two or three countries are becoming a feature of regional economic cooperation.

SEZs can make important contributions to growth and development

SEZs can help attract investment, create jobs and boost exports – both directly and indirectly, where they succeed in building linkages with the broader economy. Zones can also support global value chain (GVC) participation, industrial upgrading and diversification.

Zones are a key investment promotion tool. The advantages of clustering and co-location economies are an important attraction for investors. In many countries, the incentives, infrastructure support and business facilitation in SEZs are meant to compensate for weaknesses in the investment climate. However, zones are neither a precondition nor a guarantee for above-average performance on FDI attraction. Only about half of investment promotion agencies worldwide believe the zones in their country have given a significant boost to FDI attraction.

In many countries, zone programmes account for a major share of exports, particularly manufactured exports. SEZs have been a key component of export diversification efforts in developing countries, and they have been instrumental in improving countries’ participation in GVCs. Trade costs such as tariffs, border taxes and fees, accumulate when intermediate goods are imported, processed and then re-exported in complex GVCs. By lowering such transaction costs, SEZs have become major hubs in GVCs.

Zones are often an effective tool for job creation, particularly for women. The impact of SEZ jobs in countries with high rates of unemployment and underemployment is significant. Especially in the poorest countries, SEZs can be an important avenue to formal employment.

However, none of the potential economic contributions of SEZs are automatic

The performance of many zones remains below expectations. Where they lift economic growth, the stimulus tends to be temporary: after the build-up period, most zones grow at the same rate as the national economy. And too many zones operate as enclaves with limited impact beyond their confines.

In addition, it is important to consider the social and environmental impacts of SEZs. Zone labour standards, in particular, have often raised concerns in the past. This is changing in modern zones. ESG practices are improving; more than half of the SEZs polled in an UNCTAD survey have policies on environmental standards and regulations, and some have adopted international environmental standards.

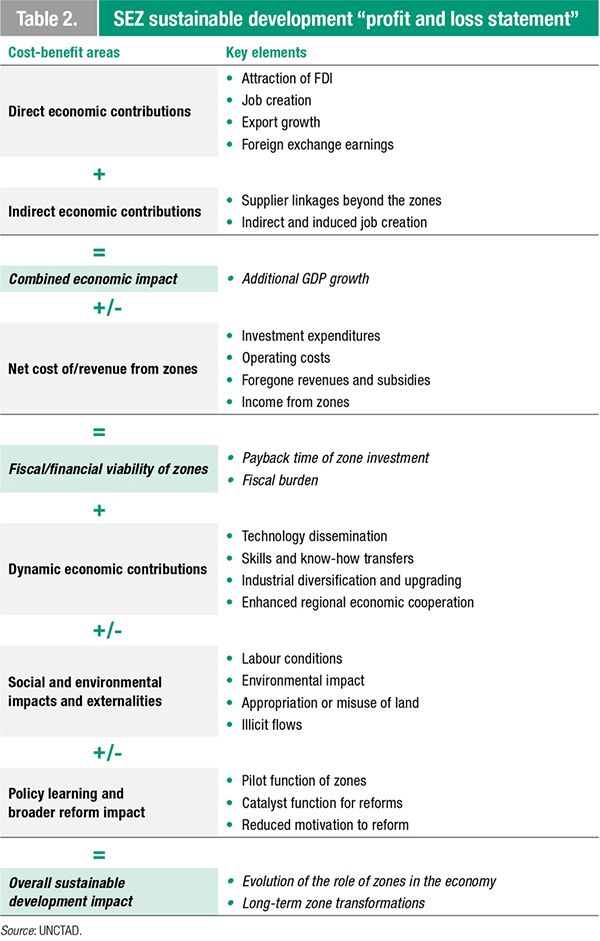

To date, few countries systematically assess the performance and impact of SEZs, and even fewer have instated mechanisms to deal with underperformance. Doing so is critical, because the turnaround of unsuccessful SEZs requires timely diagnosis, especially when there has been a significant level of public investment in zone development. UNCTAD’s SEZ Sustainable Development Profit and Loss Statement (P&L) can guide policymakers in the design of a comprehensive monitoring and evaluation system (table 2).

Lessons learned for modern zone development

Strategic design of the SEZ policy framework and development programme is crucial. The types of zones and their specialization should build on existing competitive advantages and capabilities. Some less developed countries have sought to attract high-tech investors into SEZs to leapfrog into higher value added activities and accelerate economic growth. Yet high-tech zones in environments that lack key locational advantages for such activities – including sufficiently skilled resources, research institutions and the amenities to attract specialized foreign personnel – may not be viable. Zone development plans should be long-term and guided by the SEZ development ladder.

Zone development programmes should take a frugal approach. The SEZ Sustainable Development P&L emphasizes the need for financial and fiscal sustainability of zones, as their broader economic growth impact can be uncertain and take time to materialize.

Few countries conduct comprehensive assessments of zone benefits against costs, including initial investment expenditures and operating costs. Zones have the potential to provide development benefits beyond direct economic and financial gains, supporting economic transformation objectives, technology and skills development, and policy experimentation opportunities. These development benefits can justify public investment in zones. However, the financial and fiscal viability of zones is important for long-term sustainability. High upfront costs due to overspecification, subsidies for zone occupants and transfers to zone regimes of already-operating firms pose the greatest risks to fiscal viability. Outsourcing zone development to the private sector can substantially reduce the capital cost for governments, as well as some of the risks involved.

The success of individual SEZs depends on getting the basics right. Most failures can be traced back to problems such as poor site locations that require heavy capital expenditures or that are far away from infrastructure hubs or cities with sufficient pools of labour; unreliable power supplies; poor zone design with inadequate facilities or maintenance; or overly cumbersome procedures. The facilitation of administrative procedures for businesses and investors in the zone through regulatory streamlining and one-stop shops or single windows is a must.

Active support to promote clusters and linkages is key to maximizing development impact. Firms operating in zones can benefit from network effects and economies of scale. Zone specialization helps to promote clustering. Firms operating in the same or adjacent industries have greater scope to collaborate, pool resources and share facilities than firms operating in unrelated industries. Nevertheless, even multi-activity zones can extract some of the benefits of co-location. Firms in different industries can share common services in the zone. Pro-active identification of opportunities, matching efforts and training programmes, with firms within and outside the zone, significantly boosts zones’ impact.

A solid regulatory framework, strong institutions and good governance are critical success factors. The legal infrastructure of SEZs should ensure consistent, transparent and predictable implementation of SEZ policies. The responsibilities of SEZ governing bodies should be clearly defined. The autonomy of the governing body, particularly in the context of an increasing number of private zones, is important to minimize conflicts of interest.

The choice between public, private or public-private partnership zone development models depends on the country-specific policy and legislative context and on the types of SEZ that governments aim to develop. Private sector zone development offers advantages, including a better understanding of appropriate levels of investment and facilities best suited to the zone and access to an established network of investors (tenants) in the zone.

Modern SEZs face a triple challenge

Where policymakers need to turn around struggling SEZs or to adjust zone programmes that fail to deliver on objectives, they need options for reorienting their strategic approach, reforming zone regulations and repackaging zone benefits. That need may become increasingly acute with the evolution of three key challenges: the sustainable development imperative, the new industrial revolution and the digital economy, and changing patterns of international production and GVCs.

The sustainable development agenda increasingly drives MNEs’ strategic decisions and operations, which should be reflected in the value proposition that SEZs market to investors. Laxer social and environmental rules or controls are not a long-term viable competitive advantage to attract investment in zones. SEZs marketing their environmental performance (ecozones) are already emerging, and the enforcement and active promotion of high ESG standards will increasingly become a feature of SEZs.

Modern SEZs can make a positive contribution to the ESG performance of countries’ industrial bases. Controls, enforcement and services (e.g. inspectors, health services, waste management and renewable energy installations) can be provided more easily and cheaply in the confined areas of SEZs. Fiscal incentives conditional not only on employment, investment or export performance, but also on a range of social and environmental indicators have the potential to become a key tool driving SEZs’ ESG performance and sustainable development impact.

In line with the SDGs, that impact should include gender equality. SEZs are traditionally big employers of women, with about 60 per cent female employees on average. Some modern zones are implementing gender equality regulations, such as anti-discrimination rules, and support services, such as childcare and schooling facilities, setting new standards for SDG performance.

The new industrial revolution and the digital economy are changing manufacturing industries – the main clients of SEZs. The declining importance of labour costs as a locational determinant for investment will have fundamental implications for SEZs. SEZ development programmes will need to adapt their value propositions to include access to skilled resources, high levels of data connectivity and relevant technology service providers, potentially through partnerships with platform providers. Digital service provision by SEZ operators, e.g. through online single windows for administrative procedures, becomes an increasingly important signal to potential investors. At the strategic level, SEZs may have new opportunities to target digital firms and orient their strategic strengths in logistics facilitation towards the distribution activities in digital value chains. SEZs could also act as incubators and promote clustering and linkages with digital start-ups within and outside their confines.

Changes in patterns of international production and GVCs are a feature of the current challenging global policy environment for trade and investment, with rising protectionism, shifting trade preferences and a prevalence of regional economic cooperation. These changes can significantly affect the competitiveness of SEZs, which function as central nodes in GVCs. International cooperation on zone development is likely to become increasingly important. The trend towards more regional rather than multilateral economic cooperation is likely to give further impetus to the development of regional and cross-border zones.

The future: SDG model zones

The sustainable development imperative is arguably the most urgent challenge facing policymakers, zone programme developers and zone managers today. The 2030 Agenda for Sustainable Development provides an opportunity for the development of an entirely new type of SEZ: the SDG model zone. Such zones would aim to attract investment in SDG-relevant activities, adopt the highest levels of ESG standards and compliance, and promote inclusive growth through linkages and spillovers.

SDG model zones could act as catalysts to transform the "race to the bottom" for the attraction of investment (through lower taxes, fewer rules and lower standards) into a race to the top – making sustainable development impact a locational advantage.

This process of modernizing zones and building SDG Model Zones can benefit from a global exchange of experience and good practices. Also, with more and more zones being developed through international partnerships, a global platform that brings together financing partners, SEZ developers, host countries, investment promotion agencies and outward investment promotion agencies, as well as impact investors, can accelerate the transition towards sustainable development-oriented zones. UNCTAD can play a leading role in establishing such a platform in connection with its World Investment Forum, and in supporting partnerships through its policy advice, technical assistance and training programmes. The key objective should be to make SEZs work for the SDGs: from privileged enclaves to sources of widespread benefits.