Where do economies of scale come from?

(Part II of a series on economies of scale in construction. See here for Part I.)

If we’re going to understand why construction has so few economies of scale, it’s useful to know what causes economies of scale to occur in the first place. Economies of scale are the result of several different mechanisms.

Fixed/threshold cost scaling

A process typically has some costs that are proportional to output (variable costs) and some that aren’t (fixed costs). Increases in output will spread the fixed costs over a larger number of units, making the per-unit cost go down.

For instance, many of the costs for developing a new drug - research to find a candidate drug, running animal and human trials, finding a way to manufacture it at scale - are the same regardless of how many doses of the drug are sold.

Likewise, the costs of product design are the same whether 100 or 100,000 copies of the product will be produced. This allows producers of high-volume products to spend much larger amounts on the design of the product. A new model of car, for instance, might cost several billion dollars to develop (Ford spent more than $2.7 billion on developing the 1993 Ford Taurus.) An apartment building, on the other hand, will have many more parts than a car, but might have total design fees in the neighborhood of just a few hundred thousand dollars

Similarly, there also may be production or operational methods that have low variable costs, but high upfront costs, and only make sense to use at high production volumes. Cotton fiber, for instance, can be spun into thread by hand using a relatively simple spindle. Machine spun thread can be made much cheaper, but requires a substantial upfront investment in the machine and equipment. Similarly, injection molding of small plastic parts has significant upfront costs for making the mold, and it's only at high enough volumes that this method is cheaper than something like 3D printing.

Fixed costs are often fixed only over a certain range - at some point, they will increase in response to output, resulting in a series of "cost cliffs". Overhead costs often fall into this category - for instance, the rent paid on office space will be independent of how many people are in it and how much work they do, but at some point the company will grow enough that bigger offices are needed.

Fixed costs can also often be thought of as setup costs - steps that need to take place at the beginning of a process. The longer your process runs, the more those costs get spread out.

Efficiencies from specialization can also be thought of in terms of fixed cost scaling. Producing something generally requires a series of processes that occur one after the other. A single worker doing all the steps will incur setup costs each time they switch to a new process or task, setups which are eliminated if you can devote a separate worker for each task (similar logic applies at the level of the machine, and the level of the firm.)

(These aren’t the only gains from specialization, which also sees gains from learning curve effects as well as being able to segment your labor more efficiently.)

Geometric scaling

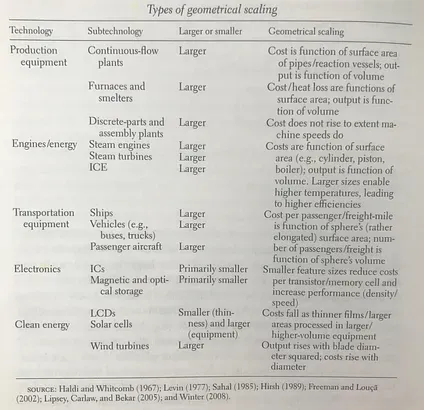

A process often gets more efficient if the equipment for it is made physically bigger. This is often due to area/volume relationships - doubling the radius of a sphere increases the surface area by a factor of 4, but increases the volume by a factor of 8. Processing equipment (chemical factories, oil refineries, etc) often has costs that rise in proportion to surface area, but output that rises in proportion to volume. Engines, likewise, often have costs that rise in proportion to surface area but power that rises in proportion to volume, making larger engines cheaper on a per-output basis. Transportation (ships, buses) often show similar effects.

Funk 2013 gives some examples of geometric scaling in various industries:

Statistical scaling

A larger volume of output might require less buffering against random variation. If a company operates just 1 machine, for instance, it might need to keep a supply of spare parts in stock to ensure the machine will always be operational. But a company that operates 100 machines will need far fewer than 100 times the spare parts, because it’s very unlikely that all 100 machines will break down at the same time.

Whitin 1954 gives several examples of this sort of scaling:

The repairman problem - For machines which break down occasionally and need to be repaired, the number of maintenance staff rises much slower than the number of machines.

Inventory control - the amount of safety stock needed to ensure random variation in demand can be met rises proportionally with the square root of demand.

Cash reserves - the amount of cash a bank needs to keep available for withdrawals rises less than proportionally than volume of deposits

Quality control - The number of items that need to be inspected to ensure a given level of quality rises with the square root of output.

A larger firm may also be less likely to be negatively impacted by random changes in demand. A regional economic downturn, for instance, might have a much larger effect on a local business than a national one.

Increased influence

Larger companies, by virtue of their size, can often obtain their production inputs more cheaply. They may be able to obtain better financing terms, negotiate better deals with vendors, or force suppliers to conform to their product specifications or other requirements. Apple, for instance, has a somewhat involved compliance program for its suppliers.

Learning curve effects

Production efficiency tends to improve at a rate proportional to cumulative volume of production. A firm that operates on a larger scale thus might accumulate more production process improvements that lower their costs. (We previously looked at learning curves in construction here.)

In addition to economies of scale there are also diseconomies of scale - mechanisms that cause costs to increase as output increases.

Coordination diseconomies

Coordination costs for a firm may rise faster than output increases. For an organization of size N, each new person hired creates N-1 potential lines of communication, and an organization that doubles in size might double the amount of administrative overhead, making each worker less efficient. Anecdotally, it does seem as if large companies spend a proportionally larger fraction of time in meetings, and make decisions much more slowly.

This sort of thing is difficult to avoid - even a highly decentralized decision making structure will have trouble avoiding new layers of bureaucracy as the organization grows.

Transportation diseconomies

As the number of units sold increases, they may have to be transported farther and farther away to reach additional customers, increasing transportation costs. Similarly, easily accessible inputs may be exhausted forcing the use of ones from farther away.

Increased demand effects

A firm that grows larger will increase its use of inputs (materials, labor, etc.), which may drive up their price, or require the use of lower quality ones.

Geometric diseconomies

In some cases physical equipment for a process gets less efficient as it gets physically larger. Doubling the clear span of a beam, for instance, increases bending moment by a factor of 4, and deflection by a factor of 16, requiring proportionally more material as the span increases.

Statistical diseconomies

For physical equipment, increasing its size will also increase the number of components, which will increase the amount of downtime if quality control is not also improved. A machine with twice the capacity and twice the number of parts may also have twice the downtime, and thus less than twice the output.

Similarly, large projects take longer to build, and are thus more at risk of future disruptive or unforeseen events (as well as having higher financing costs.)

The next post in this series will look at economies of scale at the level of individual buildings.

Subscribe to Construction Physics

By Brian Potter · Hundreds of paid subscribers

Why buildings are built the way they are.

This is fabulous. As an economist who works in supply chain and operations, this nails so many points I wish I could drive into people's heads :) |

What book is the Funk 2013 page from? |

Publish on Substack

Publish on Substack