It depends on the valuation of your company at Series A stage. I’m assuming your goal as founder is to convert SAFE investment at the highest valuation (and retain maximum equity). There are three possible scenarios:

- Series A pre-money valuation is lower than $2.5M (CAP + 20%)

- Series A pre-money valuation is exactly $2.5M

- Series A pre-money valuation is higher than $2.5M

SAFE with cap of $2M pre-money and no discount is better if your Series A pre-money valuation is lower than $2.5M.

SAFE with 20% discount and no cap is better if your Series A pre-money valuation is higher than $2.5M.

If your Series A pre-money valuation is exactly $2.5M, both types of SAFE will convert at exactly same equity.

Here is a very simplified version of conversion calculation before dilution by series A investment:

SAFE Investment: $200K

Case 1: Series A pre-money valuation = $1M

SAFE with 20% will convert at 20% equity ($200K/(80% of $1M+ $200K))

SAFE with $2M cap will convert at 16.67% equity ($200K/($1M+$200K))

Case 2: Series A pre-money valuation = $2.5M

SAFE with 20% will convert at 9.09% equity ($200K/(80% of $2.5M+ $200K))

SAFE with $2M cap will convert at 9.09% equity ($200K/($2M+$200K))

Case 3: Series A pre-money valuation = $4M

SAFE with 20% will convert at 5.88% equity ($200K/(80% of $4M+ $200K))

SAFE with $2M cap will convert at 9.09% equity ($200K/($2M+$200K))

"Founder-friendly" is not synonymous with giving early investors a bad deal.

To rephrase the question: Which is the least dilutive or provides the highest company valuation?

The uncapped, obviously.

The pre-money valuation of your Series A vs the valuation used by the uncapped SAFE, vs the valuation used by the capped SAFE:

Series A - Uncapped - Capped

$20M- $16M - $2M

$10M - $8M - $2M

$5M - $4M - $2M

$2.5M - $2M - $2M

$2M - $1.6M - $2M

$1M - $0.8M - $1M

They are equal or worse only at a Series A pre-money valuation of $2.5M and below, which is too low of a valuation for any Series A deal.

$2M cap i

… (more)It depends on the terms of the next round.

In most realistic cases, the uncapped note will be better. Uncapped notes are not common.

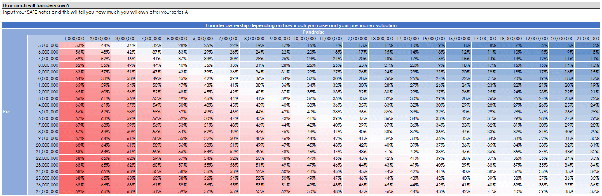

If you want to see how this works, I’ve made a free tool to do the calculations for you.

You can see a sensitivity table on what your ownership will be depending on how much you raise and the valuation.

It works for post post and pre money SAFEs.

Download: Post Money SAFE Calculator -

At Asana, we’ve spent years developing the best work management platform

for team management and collaboration, which we believe is the backbone of productivity. When your team is organized and connected, you can improve productivity, reduce "work about work

" like ineffective meetings and email bloat, and do better work.

So if you’re looking to avoid the roadblocks that hinder productivity for even the best of teams, look no further. Here are eight tips for improving team organization and connection and—in turn—boosting both the speed and quality of your team’s work:

Eliminate unnecessary meetin

… (more)The most founder friendly is a SAFE with a 20% discount and no cap. Smart money will rarely accept a deal like this except in very specific situations. One case where it often makes sense is when a bridge round is being supported by insiders (who already own shares) who don’t want to influence an upcoming Series A that will take place shortly.

An investor an an entrepreneur are talking over coffee:

Entrepreneur: I'm raising a convertible note. Are you in?

Investor: I hate convertible notes. Most of my investor friends do too. Can't you make this a priced round?

Entrepreneur: Nope. Paul Graham says I should do a note. I'm going to do a note. Why don't you like notes?

Investor: I have a really good idea of how the trajectory of each investment I do has to go, at a minimum. For this to be a good use of my money I need to own a certain % of the company. You have to own enough of the company throughout the journey to make it worth your while. So do I. If I can't do that with you then there are plenty of other startups that I can put this same money into in which I can.

Entrepreneur: Is see. So what would this ownership number have to be off the bat?

Investor: Its a moot point, because with a note we can't control who will own what. You could ink Oracle as your first customer next month and your next round will be at a $30m valuation, making my 200k investment stake now too low for me.

Entrepreneur: I see. What if we somehow put clause in that allows you to still invest in the note but guarantees you that you'll own whatever this certain % is when I raise my next round. Like a limit on how small your stake will go. A floor, I suppose.

Investor: Sounds good. Instead of calling my ownership % as a floor, though, let's simplify by coming up with a limit to your next valuation as it applies to my investment only.

Entrepreneur: OK. I think we'll call it a "cap".

Investor: We will go far together, grasshopper.

This might sound unconventional, but I’d go with blue-chip art.

A Basquiat painting soared 2,209,900% when it was bought for $5,000 and sold for $110,500,000 in 2017.

Obviously, you’ll probably never see results like that again, but these numbers still show that art can be a powerful financial asset.

Also if you can find gains like that anywhere else let me know, because I’d like to see it.

And here’s more reasons why blue-chip art is a solid option for 2023:

- It has the lowest correlation to equities of any major asset class according to Citi. This means if the market dips, this asset doesn’t neces

The question asks about two different scenarios: $4 million valuation cap, and 25% discount on an original YC Safe [original version was pre-money conversion], but my focus is on the interrelation between the valuation cap and discount because this is often misunderstood.

There’s a simple heuristic that founders and investors can use to quickly determine which is better: The discount or valuation cap?

Here’s a formula to determine if the discount or valuation cap is better:

Where Discount Rate = 100% - discount.

- e.g., 100% - 20% = 80%.

Note that this means for a

Your question is wrong. If you know what the next round valuation will be, you might as well do a priced round. One of the primary reasons to use a safe SAFE or convertible note is to cover uncertainty about what that valuation might be.

That said, I would always take an uncapped note in this scenario. If I knock it out the of the park and my next round is at a very high valuation, I retroactively gave away more equity if my prior round was capped.

Honestly? Installing one of those little apps that auto-applies coupons when you shop online.

I typically hate browser extensions but I have saved so much money using them (I use Capital One Shopping, but Honey is good too).

Saved me $26 on my blender:

Whenever you shop, it will 1) automatically look for coupon codes and apply them, and 2) look for cheaper prices on other sites.

Free to use, but only works on desktops I think. Here’s a link.

It's usually not one or the other, the majority of convertible notes have both a cap and a discount.

Both the discount and the cap function to provide early investors with a lower valuation than later investors (investors in the priced round). This is required because the early investors are taking more risk, they are putting their money to work earlier (time value of money), and often they have less capital to invest (angels versus VCs).

A discount offers a fixed/predictable valuation differential. There's always a discount; it doesn't matter what the valuation is. This is risky to the entrepre

… (more)Gil's answer is correct. SAFEs are a simple, company-friendly structure that works only in cases where either the company can dictate the terms, or the investor doesn't care about them.

The first case includes hot rounds that you as an investor must get into at any cost, or friends and family rounds where the company is setting the terms unilaterally.

The second includes unsophisticated investors, or sophisticated investors who are either making a 'throw away' investment, or who are effectively just buying a lottery ticket with a tiny investment, figuring that they'll save their negotiating for

… (more)I don't care too much what the SAFE terms are if I'm investing after a SAFE (or SAFEs plural), per se.

All I "really" care about is the post-money valuation (i.e., what the company is valued at after the round closes), and how much I paid and own. And that the founders own enough after the round.

You have to live with what you did before in terms of fundraising. That just rolls up into the cap table. That's what you agreed to, often without fully realizing what it was. Discount, no discount, last-minute discount, overpriced (beyond this round), underpriced, capped, uncapped, semi-capped ... I do

… (more)A2A here -- I agree with Steven Chen's answer fully. Here are a few additional practical thoughts and issues to consider:

- The idea of a discount with a cap that is on the low side for your company (assuming you are even remotely correct on its value over the next months) simply does not make sense. I would push to have the cap moved much higher as your solution - to $4mm in your case.

- How much $$ are you talking about on this Note? If this is $100,000, you can be a lot less concerned about taking the money vs. $500,000 -- this is the practical answer. The big issue is how the Note will convert

Full disclosure at Pettable we offer a service that helps people with emotional or mental disorders connect with licensed professionals who can write legitimate ESA letters - you can find out more here: https://pettable.com/

In answer to your question. Under the Fair Housing Act housing providers such as landlords cannot charge their tenants pet rent, a pet deposit, regular pet fees, or surcharges regarding their ESA animal. Because ESAs are not considered pets under the Fair Housing Act, all pet-related rules in place do not apply to your ESA, including monetary rules.

That being said, an ESA o

… (more)Discount rates typically range from 0-30%, with most being in the 20% range. Caps are usually in the single digits, whether high, mid or low depending on the quality and experience of the team, as well as the funding environment.

On the face of it, there is nothing extraordinary about the terms of such an offer. The unknown aspect of reasonability is what you project the company will do, and what the investor’s ROI expectations are, and what other aspects of the deal are critical to the offerer and investor.

For instance, in the case of a liquidation event, a convertible note ( "debt") favors the investor, while a SAFE note (a similar vehicle that is "equity") may favor the founders . But if there is any form is acceptable to both parties, then it is reasonable to choose that form.

So the remaining question of reasonabil

… (more)