What Is Fat FIRE? The Best Early Retirement Lifestyle

Fat FIRE (Financial Independence Retire Early) is being able to live it up in retirement without having to sacrifice your spending.

If you are Fat FIRE, you can easily survive without a job because your investment income more than covers your best life's living expenses.

You don't need to work part-time or do anything to supplement your life. Further, if you are Fat FIRE, you can live in some of the world's greatest cities without worrying about costs.

I've been writing about Fat FIRE since I started Financial Samurai in 2009. I retired early from my finance job in 2012 with about $80,000 a year in passive income. Back then, I considered myself normal FIRE.

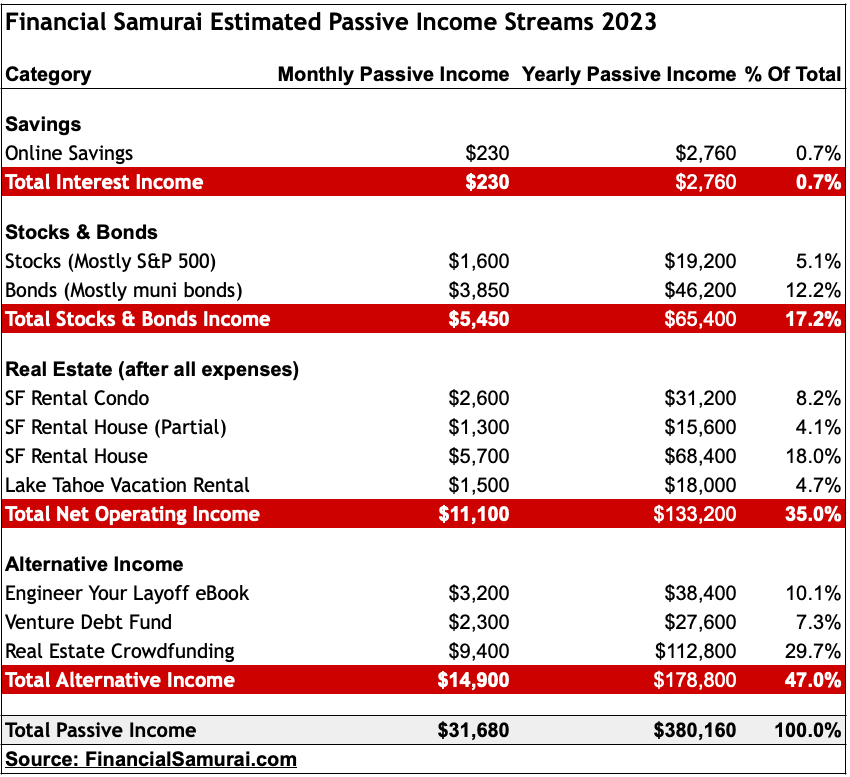

However, I didn't consider myself Fat FIRE until my passive income reached $200,000 a year in 2017. Today, my passive income is over $300,000, a level which I considered Fat FIRE. It's expensive to live in San Francisco, especially with two kids!

Fat FIRE allows you to:

- Live in the most expensive cities in the world, which all have wonderful culture, food, nightlife, entertainment, schools, arts, and better weather

- Live in a comfortable house with at least three bedrooms, two bathrooms, and a yard if you have one or more kids, or a luxury two bedroom or greater condo if you are a childless couple or individual

- Save or have enough to pay for all your children's college education

- Travel for 8 or more weeks a year while living in 4 or 5 star hotels

- Drive a safe and reliable car that's not older than five years

- Feel less angst and anxiety as parents for your children's futures

- Eat and drink the finest foods (toro sashimi, wagyu steak, jamon iberico, caviar, etc)

- Afford excellent healthcare (gold plan or higher without needing subsidies)

- Take care of all your parents financial needs since they sacrificed so much to raise you

- No need for either partner or spouse to work every again

Fat FIRE is at the opposite end from Lean FIRE. Lean FIRE is where individuals cut their expenses to the bare bones in order to survive.

Lean FIRE examples include:

- A couple living in a cramped studio, van, or air stream

- A couple deciding never to have kids due to costs

- Being unable to afford living in the world's greatest cities due to costs

- Not saving up enough to pay for private grade school or public or private university

- Living in a low cost area of the country where it's more homogenous

- Living abroad to lower costs

There's nothing wrong with Lean FIRE. Having a minimalist lifestyle while doing what you want is great. Fat FIRE and Lean FIRE are simply two ends of the financial independence early retirement spectrum.

In between is Barista FIRE. Barista FIRE is where an early retiree works a part-time job or forces their partner or spouse to work a part-time or full-time job for extra income and benefits.

How Much You Need To Fat FIRE

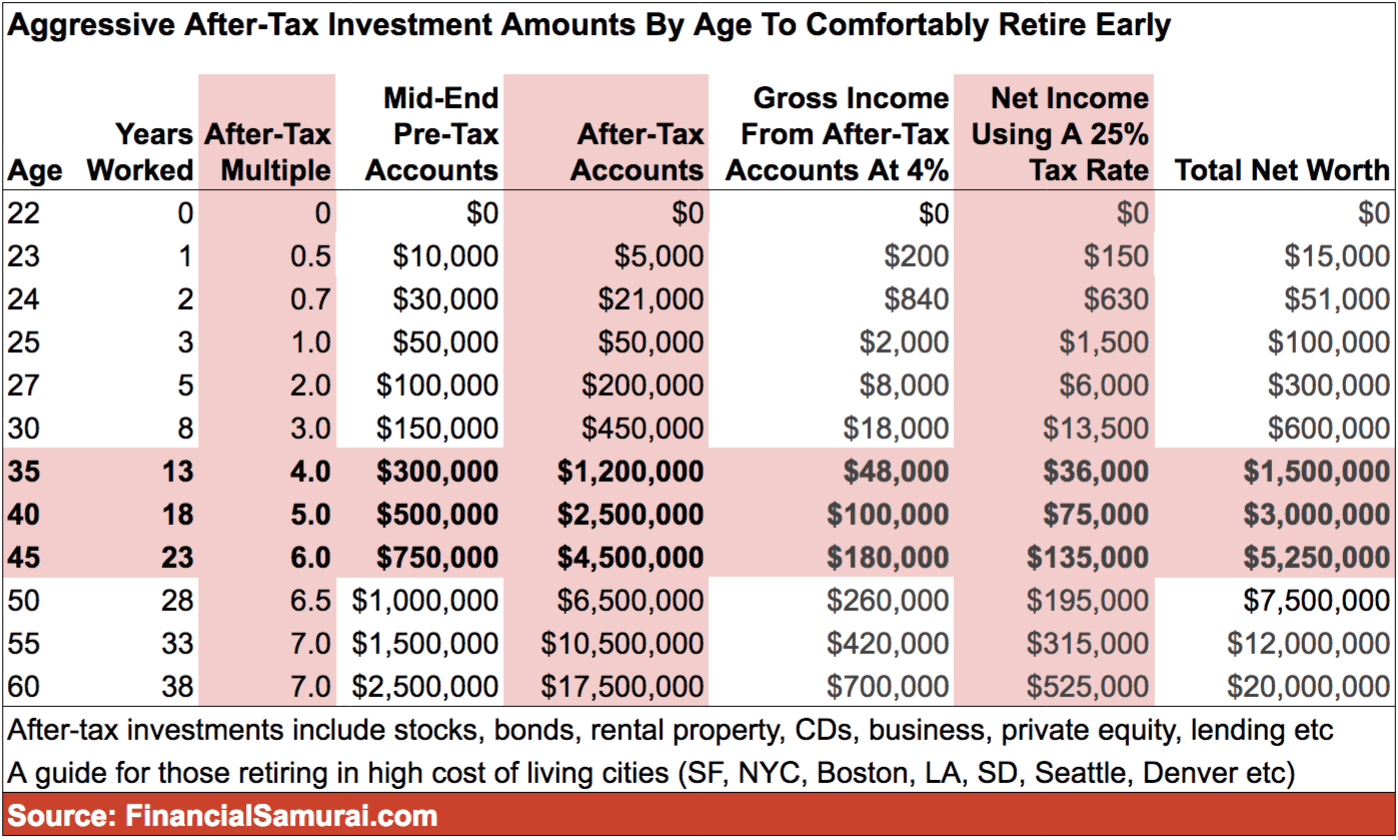

Based on my after-tax investment amounts by age, if you want to live the Fat FIRE lifestyle in places like San Francisco, New York, Los Angeles, Washington DC, Boston, San Diego, Seattle, Miami, or now Denver, you need to accumulate the following amount of wealth by age.

The chart highlights a realistic amount of money the most aggressive saver, investor, hustler, and calculated risk-taker can take in order to achieve the Fat FIRE lifestyle sooner, rather than later. Some of you will be able to accumulate much more. While some of you might be able to get by with a little less.

If you want to live the Fat FIRE lifestyle, I would NOT retire before the age of 40 with less than $3 million in the bank. Thanks to inflation, $3 million is really the new $1 million from the 1980s and earlier.

Even with $3,000,000 in after-tax investments, you'll only be able to generate between $30,000 – $120,000 based on a 1% – 4% rate of return. In low interest rate environments where valuations are extremely expensive, it's not a great idea to risk too much of your capital if you are Fat FIRE.

Earning up to $120,000 a year from a $3,000,000 portfolio is great if you are single or are a childless couple. However, if you want to live the Fat FIRE life raising a family, I say you need at LEAST $5 million in investable assets. This way, your capital is generating between $50,000 – $200,000 a year based on a 1% – 4% withdrawal rate or return.

If you plan to retire live a Fat FIRE lifestyle with less than $3 million in investable assets, you probably need to work until close to 50 instead. But that's still much younger than the average retiree who retires after 61.

Ideally, you'll retire with at least a $10 million net worth or greater to live the Fat FIRE lifestyle. Once you've got investable assets greater than $10 million, you should have no problem generating between $200,000 – $400,000 a year in passive investment income.

Before you decide to walk away from your day job, however, make sure you know the risks of FIRE. The better you understand what your new lifestyle could be like, the better.

Example of a Fat FIRE Lifestyle

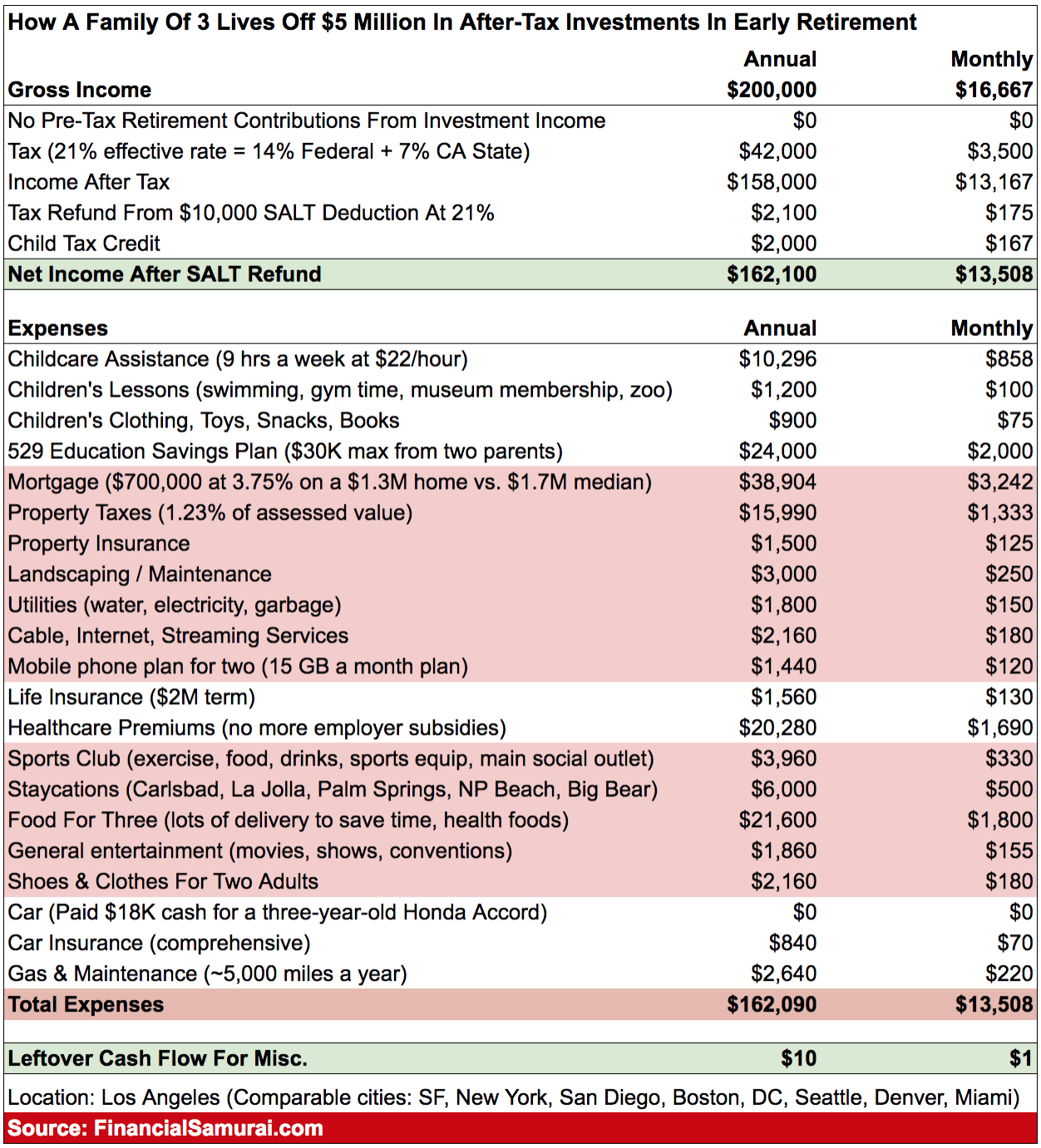

To give you an idea of what $200,000 a year in passive income can cover, let's profile Jerry, a Financial Samurai reader's budget. Jerry is 45 years old, has an 8-month-old daughter and a non-working spouse named Linda, 38. They've lived in Los Angeles for the past 20 years.

Both have decided to retire early in order to spend as much time as possible with their daughter. After both negotiated severance packages equal to $100,000 for Jerry and $60,000 for Linda, they have a combined net worth of roughly $6,300,000.

Their net worth includes the $600,000 in equity they have in their primary residence. They also have $700,000 in their combined pre-tax retirement accounts.

Their goal is to never go back to full-time work again. They perhaps will do some part-time consulting once their daughter goes to kindergarten in five years. Neither parent is doing any sort of side hustling at the moment. This is contrary to most early retirees I know, myself included.

Please review J&L's Fat FIRE expenses below.

As you can see from this chart, Jerry & Linda check off all the Fat FIRE boxes they:

- Live in a world class city

- Have a daughter

- Own a 3 bedroom, 2 bathroom house

- Are saving for their daughter's education

- Get to go out and eat great food

- Have a Range Rover they paid in cash

- Have great healthcare

- Neither of them work a full-time job

Budget Adjustments If Necessary

If times ever get rough, J&L could cut their expenses by contributing less to their daughter's 529 plan. They could order less food delivery. Spending less money on childcare frees up an extra $5,000 – $10,000 a year.

They could also move to a lower cost area of the country. However, they'd rather stay warm all year round, rather than face brutal Midwest winters.

Further, as a Latino (Jerry) and Asian (Linda) family with a mixed-race daughter, they prefer the diversity of LA. LA can only be matched by even more expensive places like New York City or San Francisco. This feeling of comfort is underestimated by the majority.

Instead, it seems better earn supplemental income if they need more money or want to spend more money.

Jerry worked in managing consulting for 23 years and Linda worked in digital marketing for 15 years. Prior to retiring, Jerry was earning a base salary of $300,000 + $100,000 – $200,000 in bonus. Linda was earning a $180,000 base salary + $50,000 in stock compensation.

Every $10,000 of supplemental income earned equals $250,000 in after-tax capital earning a 4% rate of return. J&L could easily consult part-time for a combined 10 hours a week. At $100/hour, J&L could earn $52,000 a year if one of the following concerns comes true.

Fat FIRE Is The Best, But Hardest Way To Retire Early

When you are no longer working for money, it's best to have as much money as possible. There's no point retiring early if you're going to constantly stress about whether you have enough money to pay the bills.

With Fat FIRE, you are truly free to live like a boss. As a Fat FIRE, you can do whatever you want, wherever you want in the world. And if you choose to earn supplemental income because it makes you happy, by all means do so. Pad your net worth even more so you can Fat FIRE even bigger.

Financial Samurai is focused on Fat FIRE. We want to help readers build great wealth through not only aggressive savings, but smart investing.

Once you accumulate your first million, it's much easier to accumulate millions more. At the same time, it's much easier to lose a large absolute dollar amount of money. This is why proper net worth diversification and asset allocation is a must.

You've got one life to live. Get smart. Make money. And live the life of your dreams. Once you've accumulated enough wealth, you've got to focus on protecting your wealth.

I'm Going For Fat FIRE

With two kids and a non-working spouse, my goal is to achieve Fat FIRE again. I was Fat FIRE before we have kids, and now I've moved the goal post.

To provide for a Fat FIRE lifestyle in SF, we've estimated needing $300,000 in passive to semi-passive investment income. However, with inflation, I'm shooting to generate $350,000 in passive income before I re-retire over the next couple of years.

Below is my current passive investment income budget for 2023. It could be up to 5% conservative given there is 15%-20% upside to rental income and distributions from my private real estate investments should accelerate this year. Further, Treasury bond, CD, and money market interest rates are elevated.

I want to re-retire under the Biden Presidency. Taxes are going up, but the social safety net is getting stronger. Therefore, I figure there no point working as hard.

In the meantime, I'm currently actively investing in rental properties and real estate crowdfunding to increase our passive income streams to live the Fat FIRE lifestyle.

Best Book To Help You Achieve Fat FIRE

If you want to dramatically increase your chances of Fat FIRE, purchase a hard copy of my WSJ bestseller, Buy This, Not That: How To Spend Your Way To Wealth And Freedom. The book is jam packed with unique strategies to help you build your fortune while living your best life.

After spending 30 years working in finance, writing about finance, and studying finance, I'm certain Buy This, Not That will help you reach financial independence sooner than later.

Best Book To Help You Break Free From Your Job And Retire Early

My #1 catalyst for retiring early was negotiating a severance package that paid for five plus years of living expenses. Unless you retire with a pension, it may be hard to walk from your day job.

How to Engineer Your Layoff teaches you how to negotiate a severance and be free. Becomes sometimes, even if you have Fat FIRE money, it can be hard to break away. My bestselling ebook is in its 6th edition and updated for 2023 and beyond.

Use the code "saveten" during checkout to save $10.

Recommendation To Achieve Fat Fire

Sign up for Empower, the web’s #1 free wealth management tool to get a better handle on your finances. In addition to better money oversight, run your investments through their award-winning Investment Checkup tool to see exactly how much you are paying in fees. I was paying $1,700 a year in fees I had no idea I was paying.

After you link all your accounts, use their Retirement Planning calculator. It pulls your real data to give you as pure an estimation of your financial future as possible. Definitely run your numbers to see how you’re doing.

I’ve been using Empower since 2012. As a result, I have seen my net worth skyrocket during this time thanks to better money management.

About the Author

Sam worked in investing banking at Goldman Sachs and Credit Suisse for 13 years. He received his undergraduate degree in Economics from The College of William & Mary and got his MBA from UC Berkeley. In 2012, Sam was able to retire at the age of 34 largely due to his investments that now generate roughly $380,000 a year in passive income.

His favorite invest at the moment is real estate crowdfunding to take advantage of lower valuations and higher rental yields in the heartland of America. He spends time playing tennis, taking care of his family, and writing online to help others achieve financial freedom too.

FinancialSamurai.com was started in 2009. It is one of the most trusted personal finance sites today with over 1.3 million organic pageviews a month. Financial Samurai has been featured in top publications such as the LA Times, The Chicago Tribune, Bloomberg and more. Financial Samurai helped kickstart the modern day FIRE and Fat FIRE movement in 2009.

Get exclusive tips and updates in the Financial Samurai Newsletter

Join over 60,000+ savvy subscribers.

- Top Product Reviews

- Fundrise review (real estate investing)

- Policygenius review (life insurance)

- CIT Bank review (high interest savings and CDs)

- NewRetirement review (retirement planning)

- Empower review (free financial tools and wealth manager, previously Personal Capital)

- How To Engineer Your Layoff (severance negotiation book)

- Top Categories

- Real Estate

- Investments

- Mortgages

- Most Popular

- Retirement

- Career & Employment

Copyright © 2009-2023 Financial Samurai

PRIVACY: We will never disclose or sell your email address or any of your data from this site. We do highly welcome posts and community interaction, and registering is simply part of the posting system.

DISCLAIMER: Financial Samurai exists to thought provoke and learn from the community. Your decisions are yours alone and we are in no way responsible for your actions. Stay on the righteous path and think long and hard before making any financial transaction!

Do not sell or share my personal information.