Sequoia’s Pat Grady says it isn’t clear startups ‘should be accelerating’ right now — here’s why

Earlier today, we joined friend and former colleague Jon Fortt of CNBC in interviewing partner Pat Grady of Sequoia Capital, and it proved a wide-ranging conversation. You can check out the video below, but we thought there were some highlights worth pulling out for some of you, including as it pertains to the current market, which has never felt frothier.

It’s more than anecdotal. According to a recent Wilson Sonsini report, during the first quarter of this year, the median pre-money valuation for Series C and later financings hit a record $675 million — more than double the full year 2020 median of $315 million. Meanwhile, senior liquidation preferences in so-called up rounds dropped from appearing in 35% of related deals in 2017 to 20% in the first quarter — a trend that suggests that investors are removing terms in order to win deals. In some cases, founders are feeling so empowered that they are calling out investor behavior that makes them uncomfortable, which is something you didn’t see until more recently.

But Grady said not all is what it seems to those of us on the sidelines. Indeed, he said that while Sequoia’s advice to founders as recently as March of this year was to hit the gas, things have changed more recently. Specifically, he said, "In the last couple of months, a rollout of the vaccines has kind of kind of tapered, so I would say that fog has descended onto the road [and] it’s not so clear that companies should be accelerating anymore."

On how COVID has impacted Sequoia’s outlook compared with the financial crisis of 2008, when Sequoia famously published its now-famous "RIP: Good Times" memo:

PG: If you go back to that RIP memo, I’d been at Sequoia for a year or so. It was the first major disruption that I had seen — it was the first major disruption that a lot of our founders had seen. So the question we were getting was, ‘What does this mean for us?’ It was the same sort of thing that happened in March of 2020 that caused us to put out the ‘Black Swan‘ memo [when] what we said was, ‘Hey, you need to brake when you’re going into the curve, so slow down [and] make sure you kind of have your bearings.’

In March of this year what we said was, ‘Okay, now that we’re coming out of the curve, go and accelerate.’ Unfortunately, in the last couple of months, a rollout of the vaccines has kind of tapered and so I would say that fog has descended onto the road [and] it’s not so clear the company should be accelerating anymore. We’re probably in the midst of more indecision now than we were a few months ago or even a year ago. . .we’re kind of stuck in the middle. And so what we’ve been telling companies today is focus on the basics.

On the signals that suggest a slight slowdown to Sequoia, despite the current funding environment:

We don’t pay that much attention to the fundraising numbers, but we do pay attention to employees and we do pay attention to customers, and if you look across not just our portfolio but also public companies in the market at large, attrition has spiked dramatically. There are a lot of people who said, ‘Hey, I hunkered down, I worked hard, I put in my time, but now that the world is starting to open up a little bit again, I’m going to take some time off. I’m going to travel and the see family. I’m going to find a new job. I’m going to start a company.’ And so attrition numbers are actually spiking across the board.

If we look at the customer side of things — and this is not a number that you can get out of public companies because of the way they report [but it’s a number] you can see in private companies — a lot of companies added less revenue in the second quarter than they added in the first. So we actually have seen a little bit of a pullback on the customer side of things [and] that hasn’t necessarily shown up in the fundraising numbers.

On whether that pullback is good, bad or neutral for founders and investors:

The good news is the whole reason startups exist is to solve important problems in the world, and never have we had a broader array of important problems to be solved than we do right now, because both consumer behavior and the way that businesses operate has changed so dramatically in the last 12 or 18 months. So if what I just said sounds like bad news, we actually think that on balance, it’s great news, because we see these jobs opening up in the world that founders are rushing to fill. I think that’s probably why the fundraising numbers are what they are, because everybody sees all those opportunities and they’re eager to jump in.

On what happens when some of these many new opportunities invariably start to converge — given the current pace of startup funding — and portfolio companies begin to collide, as happened to Sequoia in March of last year:

We have always had a policy that we do not invest in direct competitors. What defines a direct competitor? Two companies who are going after the same customers in the same market at the same moment in time. Now, if we have a company here in the U.S. going out to the U.S. market, and our partners in India or China or Southeast Asia have a company in their market that does something similar for their market, that’s okay, and maybe someday, down the road, they all end up targeting the same sort of customers. But as long as they’re distinct markets at time zero and they don’t look like they’re converging, that’s okay.

Sequoia’s Mike Vernal outlines how to design feedback loops in the search for product-market fit

"Finding product-market fit is not a deterministic process. Most of the time, it requires iteration. It requires constant adaptation."

Copy and paste this URL into your WordPress site to embed

When we’ve ended up in companies that had conflicts, either we’ve done the right thing as in the situation you referenced, or when two companies have kind of converged over time, we’ve set up information barriers and done our best to act in good faith.

There are two products in this market. There’s a product that is faster and cheaper money. And then there’s a product that is unfair advantage. The unfair advantage could be nothing more than that Sequoia doesn’t invest in a lot of companies. We don’t invest in a new company every day. We might partner with 15 to 20 new founders in any given year, and there’s some information value in the fact that Sequoia has gotten into business with a company. So if your unfair advantage is nothing more than the fact that Sequoia chose you, so to speak, that’s still a pretty good advantage when it comes to landing customers [and] landing employees. If your product is money, feel free to give it to competitive companies, because they’re going to get money from somewhere anyway.

[Editor’s note: We also talked about whether companies can forever stay distributed, Tiger Global, and why one of Sequoia’s biggest portfolio companies, the payments giant Stripe, isn’t a public company yet. You can find that in the video below.]

Please login to comment

Login / Create AccountSign up for Newsletters

Sequoia’s Pat Grady says it isn’t clear startups ‘should be accelerating’ right now — here’s why

Google Cloud announces upcoming regions in Malaysia, Thailand and New Zealand

Upper90’s strategy of cutting checks with credit and equity may be more relevant than ever

Businesses including Stitch Fix are already experimenting with DALL-E 2

Walmart is reportedly looking at deals with streaming services

Tracking venture capital data to pinpoint the next US startup hot spots

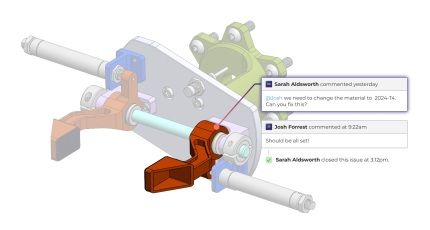

Five Flute annotates hardware product development into the current millennium

Twitter says internal systems change to blame for partial outage

How investors can still get strong returns from late-stage tech startups

Copyright law is going to get real interesting, y’all

Retention platform CleverTap bags $105 million in fresh funding

BMW hedges its EV bet, appears poised to repeat mistakes of the past

TechCrunch+ roundup: Bridge round bingo, SaaS sales smarts, tracking monthly expenses

To optimize for growth, study your down-funnel metrics

AppLovin wants to buy video game maker Unity for $20 billion

Google’s new campaign attempts to publicly pressure Apple into adopting RCS

Muon Space plans a ‘turnkey solution’ for custom Earth observation satellites

Babylon Health dials back some services in the UK

TechCrunch Disrupt 2022

Say hello to the kick-ass final agenda for the TechCrunch+ stage at Disrupt 2022

Spotify updates its home screen with new discovery feeds for music and podcasts

Truework, which helps lenders verify borrowers’ income and employment, raises $50M

Copy

Copy