Report: Stripe tried to raise more funding at a $55B-$60B valuation

When payments giant Stripe raised $600 million at a $95 billion valuation in 2021, it made headlines for raising capital at the highest-ever valuation for a privately held startup.

Defending that valuation appears to be challenging. The fintech company has reportedly approached investors about raising more capital — at least $2 billion — at a valuation of $55 billion to $60 billion. According to The Wall Street Journal, Stripe would not use the money toward operating expenses but rather to cover a large annual tax bill associated with employee stock units. It is not clear if any discussions are ongoing.

That information came to light on the same day that Stripe was said to have told employees that it had set a 12-month deadline for itself to either go public or pursue a transaction on the private market.

TechCrunch reached out to Stripe, which responded with "no comment."

The news comes after several months of apparent struggles at Stripe. In November, it laid off 14% of its staff, or around 1,120 people, saying it had "overhired for the world we’re in." And the company slashed its internal valuation more than once over the past year. Earlier this month, TechCrunch reported that Stripe had cut its internal valuation to $63 billion. That 11% cut came after an internal valuation cut that occurred six months prior, which valued the company at $74 billion.

Raising more capital at a $55 billion to $60 billion valuation would certainly be characterized as a down round — but Stripe would hardly be the first large fintech to do so. Fellow European and BNPL behemoth Klarna last year raised $800 million at a $6.7 billion valuation, an 85% drop compared to the $45.6 billion it was valued at in June of 2021.

In 2021, Stripe reportedly notched gross revenues of $12 billion and was EBITDA profitable, according to Forbes. The company’s products, in its own words, power payments for online and in-person retailers, subscriptions businesses, software platforms and marketplaces, "and everything in between." It has not publicly revealed revenue figures since 2021.

Stripe is one of many highly valued fintech startups that have hit road bumps as of late. In December, decacorn Plaid laid off 260 employees, or about 20% of its workforce, saying it had "hired and invested ahead of revenue growth."

Notably, the two companies had a bit of a public spat last year — despite being partners — when Stripe unveiled in May a new product, Financial Connections. That new product was designed to give Stripe’s customers a way to connect directly to their customers’ bank accounts, to access financial data to speed up or run certain kinds of transactions — exactly what Plaid has done historically. Plaid came out swinging months later, unveiling its own payments push.

Founded by Irish brothers John and his brother Patrick Collison (the CEO), Stripe has raised more than $2.2 billion in funding since inception from investors such as Allianz (via its Allianz X fund), Axa, Baillie Gifford, Fidelity Management & Research Company, Sequoia Capital, General Catalyst, Base Partners, GV and an investor from the founders’ home country, Ireland’s National Treasury Management Agency (NTMA).

Want more fintech news in your inbox? Sign up here.

Got a news tip or inside information about a topic we covered? We’d love to hear from you. You can reach me via Signal at 408.404.3036. Or you can drop us a note at [email protected]. Happy to respect anonymity requests.

More TechCrunch

Please login to comment

Login / Create AccountSign up for Newsletters

Report: Stripe tried to raise more funding at a $55B-$60B valuation

Lawmakers ask Department of Justice to investigate Warner Bros. Discovery merger

FTC orders supplement maker to pay $600K in first case involving hijacked Amazon reviews

In edtech, history matters: Reach Capital just closed its largest fund to date

Uber sells $400m stake in Careem super app business

UK regulators could be right about cloud portability obstacles

TechCrunch Disrupt 2023

1 month left to submit nominations for Startup Battlefield 200

Have startup valuations fallen enough to feel sane again?

Poe’s AI chatbot app now lets you make your own bots using prompts

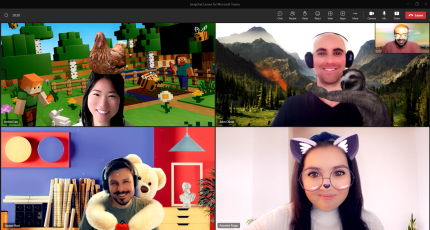

You can now access Snapchat Lenses during Microsoft Teams meetings

Meta Verified is under fire in sex work circles for revealing users’ legal names

TechCrunch’s startup-building podcast Found is nominated for a Webby Award

Twitter Circle tweets are not that private anymore

YouTube Premium adds more perks with SharePlay support, higher quality video and more

‘Star Wars: The Bad Batch’ final and third season will debut on Disney+ in 2024

After GoFundMe, Rob Solomon is flying a $200M Kite in the land of commerce

Gradient Ventures backs Axle’s ‘Plaid for insurance’ approach to data verification

EV-to-grid charging is complicated, but California is gearing up to clear the way

Twitter is now resurfacing official Russian accounts in search results

Copy

Copy