Positive Spillovers from the Pandemic

diff.substack.com · by Byrne HobartIn this issue:

Positive Spillovers from the Pandemic

Cash Leaks

Decarbonization Updates

The Instacart Model

GameStop

Telegram as a News Source

A 50/49/1 Split

Reflexive contrarians are market makers for ideas: suggest that something is true and they will, helpfully, give you the best possible reason it's false instead. This gets tiresome, but like traditional market making, it adds some value by giving you someone to hash out disagreements with. And, as with market making, it's profitable on average but always carries the risk of being run over.

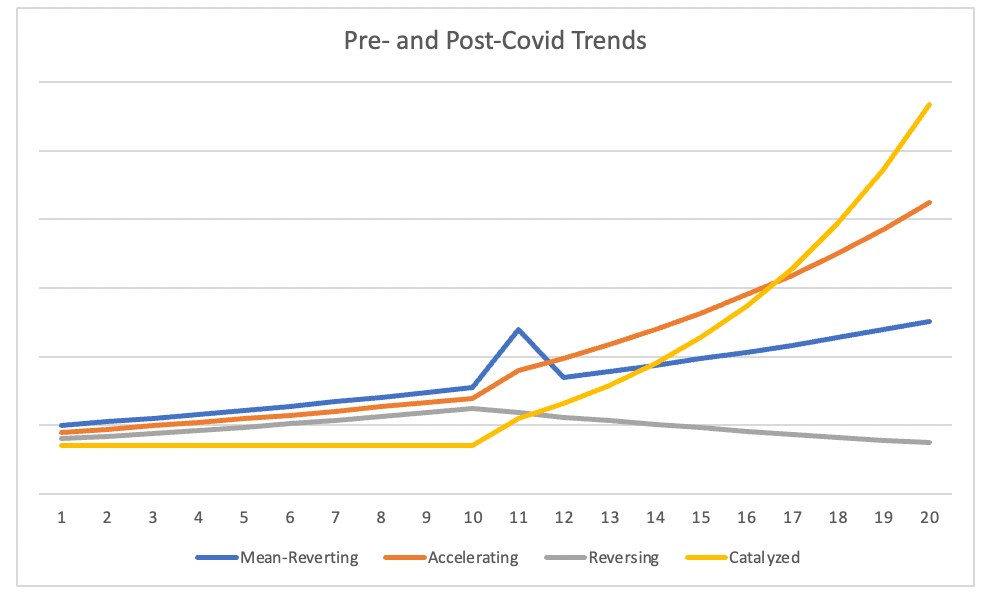

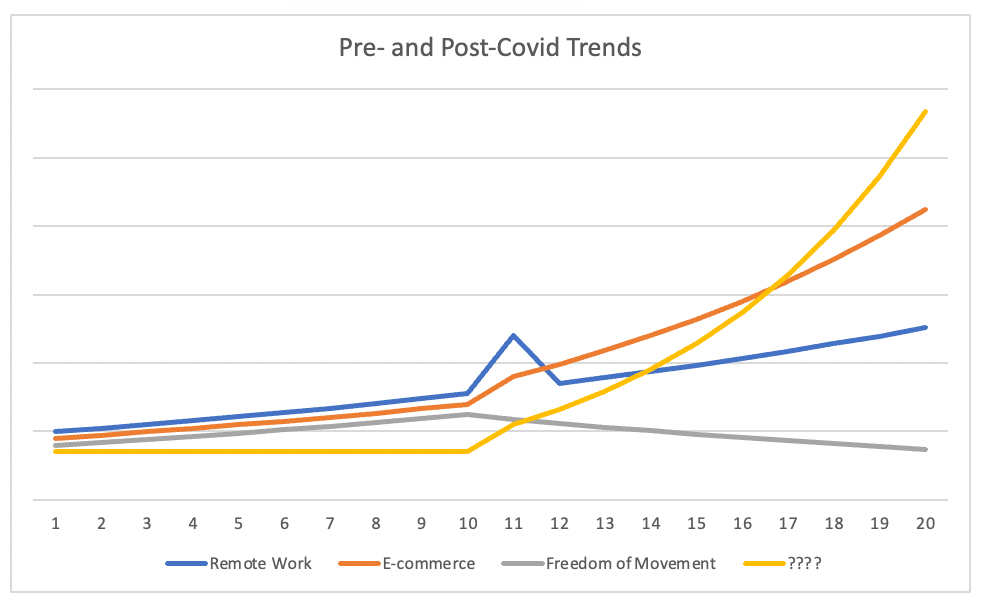

It's with that dynamic in mind that I've been wondering: what are the positive inflections that will happen due to Covid-19? 2020 was the year of rescaled Y axes, but if we plot things logarithmically, the various trends look a bit like this:

And we can label some of the trends:

Some of these might be up for debate. Zoom's stock price, for example, implies that remote work has permanently inflected upwards. On the other hand, if we were operating in a maximally remote-friendly economy, the hottest real estate markets in the country would be the cheapest. Not so. They're clusters, just different clusters: Miami, Austin, Denver, and Seattle are cheaper than the Bay and New York (for now). But people are still making the bet that they'd rather be a short drive away from investors, employers, and suppliers, rather than a flight away. And freedom of movement is still a value governments espouse. What's different today is that the places most successful at fighting Covid imposed travel bans early, while the biggest failures imposed them late and haphazardly. E-commerce accelerated, and some of that shift will persist—customers are easier to maintain than they are to acquire, and Amazon, Doordash, and Instacart have more competitive unit cost structures now that they're larger than they were a year ago. But some people will certainly return to stores once they can; the economic impact of cycling lockdowns shows that there's still demand for an in-person shopping experience.

A few trends, though, seem like they've inflected from random to directional due to Covid, and will persist for a long time after. Among them:

A lower death toll from infectious diseases due to treatment changes: early in the pandemic, I listened in on a panel in which one of the participants was a biotech VC. He'd self-quarantined early, and insisted that a vaccine was the only good solution. He got an excellent audience question: "Why should we expect a vaccine to fix this, when we don't have a vaccine for the common cold?" His answer: "We should have a vaccine for the common cold. It sucks. We should fix that next." It's good to see that kind of optimism, and as it turns out, it may be rational optimism. Moderna's vaccine famously took just a few days to develop, and was approved within a year; the previous record was mumps, which took four years.[1] Earlier this year, Moderna announced plans to develop improved flu vaccines, as well as vaccines for HIV and Nipah virus. Moderna was also about to start testing vaccines against newer strains ($, FT) just weeks after they emerged.

A lower death toll from infectious diseases due to behavioral changes: One side effect of the Covid-19 pandemic has been the temporary near-elimination of the flu ($, WSJ). Some of this is due to one-off changes, like lower international travel and lockdowns. But some of it is also because of more frequent mask use, stronger norms against close contact with sick people, and more awareness of vaccination in general. The East Asian mask trend is of relatively recent vintage; it mostly dates back to SARS in 2003, though there are much earlier antecedents. While next year's flu season will probably not be as benign as this one, it's possible that behavioral changes will reset the flu to a much lower level for years.

A permanent blurring of online and offline: While e-commerce will mean-revert someone, Internet-mediated commerce will continue to grow. It's a better marketing channel for stores (instead of earning slotting fees based on what the average person will buy when it's at the average person's eye level, stores will be able to target ads to individual people, on screens they hold right up to their faces). And it's a better logistics model, since it gives retailers an earlier look at demand. This also applies to manufacturing, where augmented reality has helped replace some business travel ($, WSJ). And for white-collar work, it ties into the trend above. The calling-in-sick tradeoff is much easier to make when home offices are at parity with traditional offices.[2]

More interest in existential risks: It's always been possible to run through a quick Fermi estimate and conclude that the world's most pressing problem is to prepare for an asteroid, an alien invasion, nuclear war, runaway AI, or some other disaster. Now that the world has experienced an existential problem—one that was warned about and that could have been mitigated—we'll probably spend more time worrying about other such risks.

A generally higher tolerance for a wider expected distribution of real-world outcomes: the first people to sound the alarm about Covid were widely seen as alarmists, and the media are careful to avoid spreading fringe theories. But anyone who heard about Covid early on is going to pattern-match to that for a long time. The economy has been very good at optimizing within narrow domains, but in the last few decades it's been worse at finding new domains, so an appreciation for the high variance and intractable distributions of the real world will lead to more interesting upside.

A crisis usually leads to some kind of reset. The "great reset" is vague, and the precise versions are too ambitious—outside of Taiwan, New Zealand, and perhaps China and Vietnam, no government got a resounding mandate for reform based on their handling of the pandemic. But a series of smaller resets is likely, and many of them will be unambiguously positive.

[1] The mumps vaccine story displays a certain sense of urgency. One night in 1963, five-year-old Jeryl Lynn Hilleman complained about a sore throat. Her father, who worked for Merck, got some supplies and took a sample to the lab that night.

[2] If everyone's commuting, sick days are discrete. But if people can work from home, they're continuous; if you're tempted to go to work and function at 50% capacity, with a chance of infecting others, a fully functioning home office setup is a good way to turn that into half a sick day and half a work-from-home day.

Elsewhere

Cash Leaks

In an early issue of The Diff, I described the $152bn Chinese conglomerate HNA as a company that "seemed to exist to transform non-RMB cash in the Chinese banking system into assets anywhere else in the world." They started as a small airline, and levered up to acquire a strange collection of businesses—an electronics distributor, a large stake in Hilton, an aircraft leasing company. By early 2018, they were defaulting on loans they took from employees ($, WSJ), always a bad sign. And now, in bankruptcy, they've revealed suspicious cash transfers among subsidiaries ($, Nikkei).

There are basically two nefarious ways to take advantage of preferential access to bank loans:

Use them to make speculative investments that no reasonable banker would back, and collect the profits, or

Just take the money.

My assumption had always been that HNA used option one, but their acquisition spree might have been more related to option two. Fortunately for the stability of China's banking system, there seems to be a correlation between a bank a) being required to make politically-favorable loans, and b) getting some form of help from the state when it's in trouble. So HNA doesn't represent a systemic risk, although it does highlight a systemic problem.

Decarbonization Updates

Exxon and Chevron have discussed a merger ($, WSJ) that would make them the second-largest oil company, after Aramco, albeit with a combined value lower than what Exxon was worth seven years ago. One analyst speculates that the merger could save $15bn in overhead and $10bn in capital expenditures—an appealing plan if demand is in terminal decline.

There are enough oil majors pivoting to renewables that it's getting competitive. Shell plans to focus on energy trading and biofuels rather than renewables, and to tilt more of its hydrocarbon exposure towards natural gas.

Keppel, a Singaporean conglomerate partly owned by the Singaporean government's main holding company, is winding down its once-core drilling platforms business ($, Nikkei) to focus on wind. This is notable because Singapore's government sometimes uses this kind of investment for strategic rather than economic purposes—if oil is no longer strategic, then Singapore, too, is betting that consumption will decline in the future.

The Instacart Model

Forbes has a detailed profile of Instacart. The most important part is their ad platform. As I've argued before, ads within e-commerce sites are a great way to monetize purchase data. That's a model pursued by companies that have lots of online loyalty data relative to their e-commerce business—but it also works for companies that have visibility into the customer's entire shopping cart, but are only paid to handle the last mile between the grocery store and the home. This is a more significant move than it seems: since grocery stores are low-margin and fees for shelf placement are close to pure profit, the grocery store model ultimately depends on in-store product placement to drive its economics. If Instacart can capture that, and do it more efficiently, they convert grocery stores into fulfillment centers, and capture the surplus themselves.

GameStop

Like the pandemic, the GameStop story is still happening, but commentary on what's happening now has been more or less exhausted, so most of the discussion centers around second-order effects.

Moontower Musings has the option trader's perspective: a stop-loss is equivalent to a synthetic option (if you sell once you've lost money, you cap your downside). And options market makers are really keeping track of the exchange rate between synthetic options and actual options.

There will be hearings on GameStop, which will probably happen once most retail investors are well underwater on their positions. (For an institutional investor, the relevant consideration right now is how much they'll earn lending GME to short-sellers, versus how much they'd pay to short it. Retail does not collect very much of these fees, often none, so they're playing a qualitatively different game.)

Alex Danco suggests that the same dynamic that propelled GameStop will shift to politics next. I'm not so sure. A stock price provides a real-time global metric of whether or not the WSB movement is working, and gives adherents funding to make other financial decisions. Politics has a slower feedback loop—join a campaign early, and you might have a better shot at a good job in the future administration and you get credit for working on a successful long-shot campaign, but your feedback loop is uncertain and happens over the course of months, rather than happening instantaneously during the trading day.

Telegram as a News Source

A Russian billionaire has claimed that he, not Putin, is the owner of the palace Alexei Navalny produced a documentary on a few weeks ago. What's notable about this is not that an oligarch would back up Putin's story, but the medium: "The businessman gave a short interview to Telegram channel Mash... The Telegram channel is a popular news outlet in Russia, boasting almost a million subscribers." As I wrote last week, messaging platforms are values-neutral: if they're a good venue for coordinating resistance to a corrupt regime, they're also a good way for the same regime to push its propaganda to a wider audience.

A 50/49/1 Split

First-past-the-post voting makes wobbly centrists the most powerful people in the world. During an election year, that means low-information voters in a small number of states; at other times, it means idiosyncratic legislators. This makes Joe Manchin one of the most important politicians in the US.

While it wasn't the intent of the US constitution to create this exact kind of randomness, it does have a perk: a closely-divided legislature with one likely swing vote is a legislature that focuses on that person's pet issues. It injects a bit more noise into a system that's otherwise subject to stasis.